Time Value of Software: How AI is Transforming Finance Operations

A Deep Dive into Finance Software, GenAI Solutions To Try, and What the Future Holds

Today, 1 in every 20 U.S. employees works in finance-related jobs, handling tasks like payroll, taxes, planning, and more. Finance roles are trending again (not just “6’5’, trust fund”), with 22% of 2024 grads applying to jobs in the sector.

Yet, finance professionals remain stuck with decades-old tech while engineering, sales, and HR ride the next wave of the software revolution. AI promises to change that, turning outdated tools into engines of growth.

So, how close are we to this new reality?

Finance Software Overview

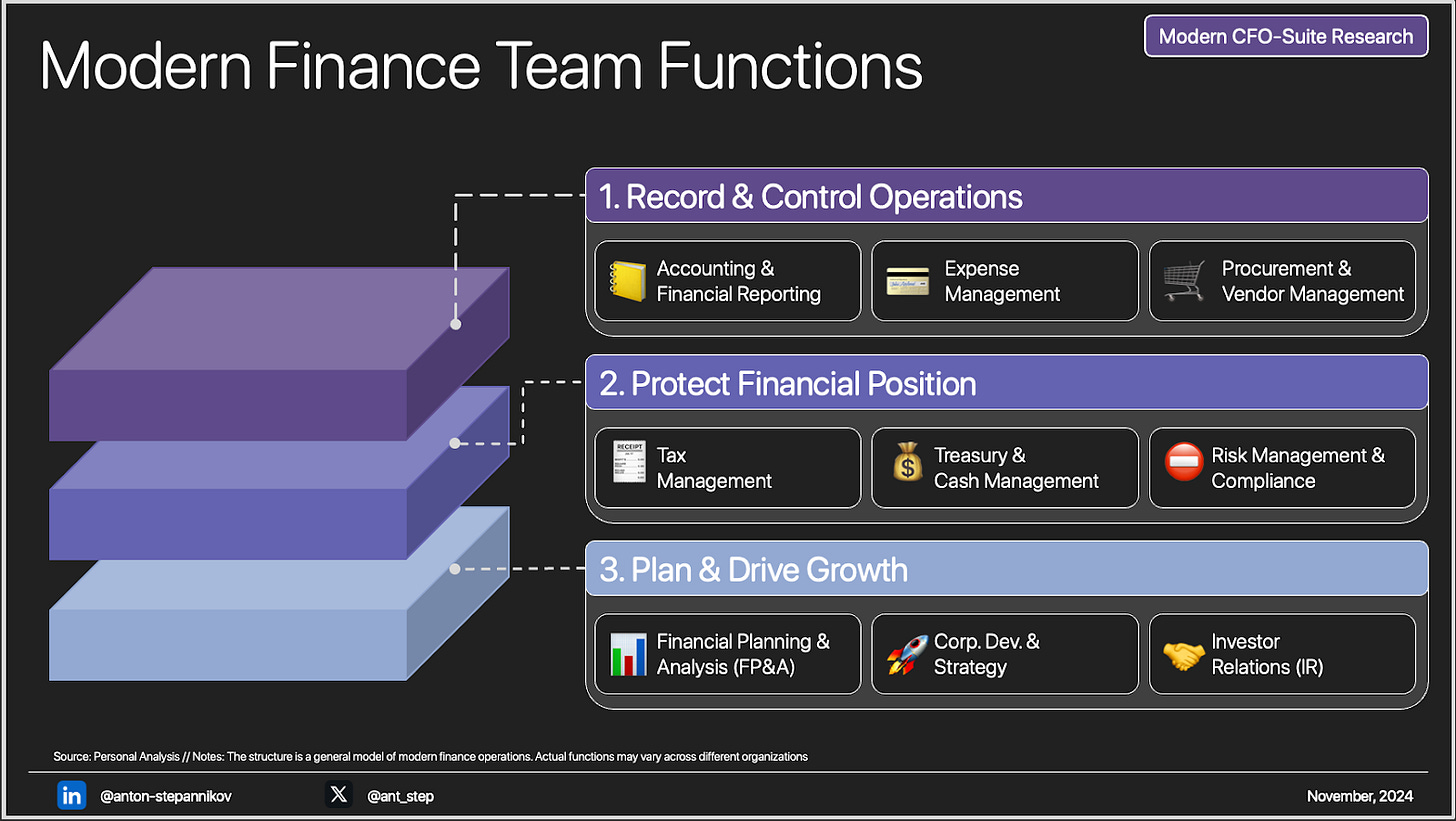

Finance teams are crucial to organizational success, operating across three primary pillars:

Record & Control Activities. Ensuring every financial transaction is accurately and efficiently recorded, forming the foundation of reliable financial data

Protect Financial Position. Safeguarding the company's financial stability against uncertainties -- from market swings to regulatory shifts

Plan & Drive Growth. Aligning financial resources with the organization's long-term vision to support sustainable growth.

While Excel was once the go-to tool for financial operations, modern businesses are investing in specialized software to enhance efficiency.

As of 2023, the finance software market surpasses $59 billion and is projected to grow over 13% annually for the next five years. This expansion is fueled by organizations moving away from manual, Excel-based processes to advanced software solutions.

Cloud Age of Finance Software

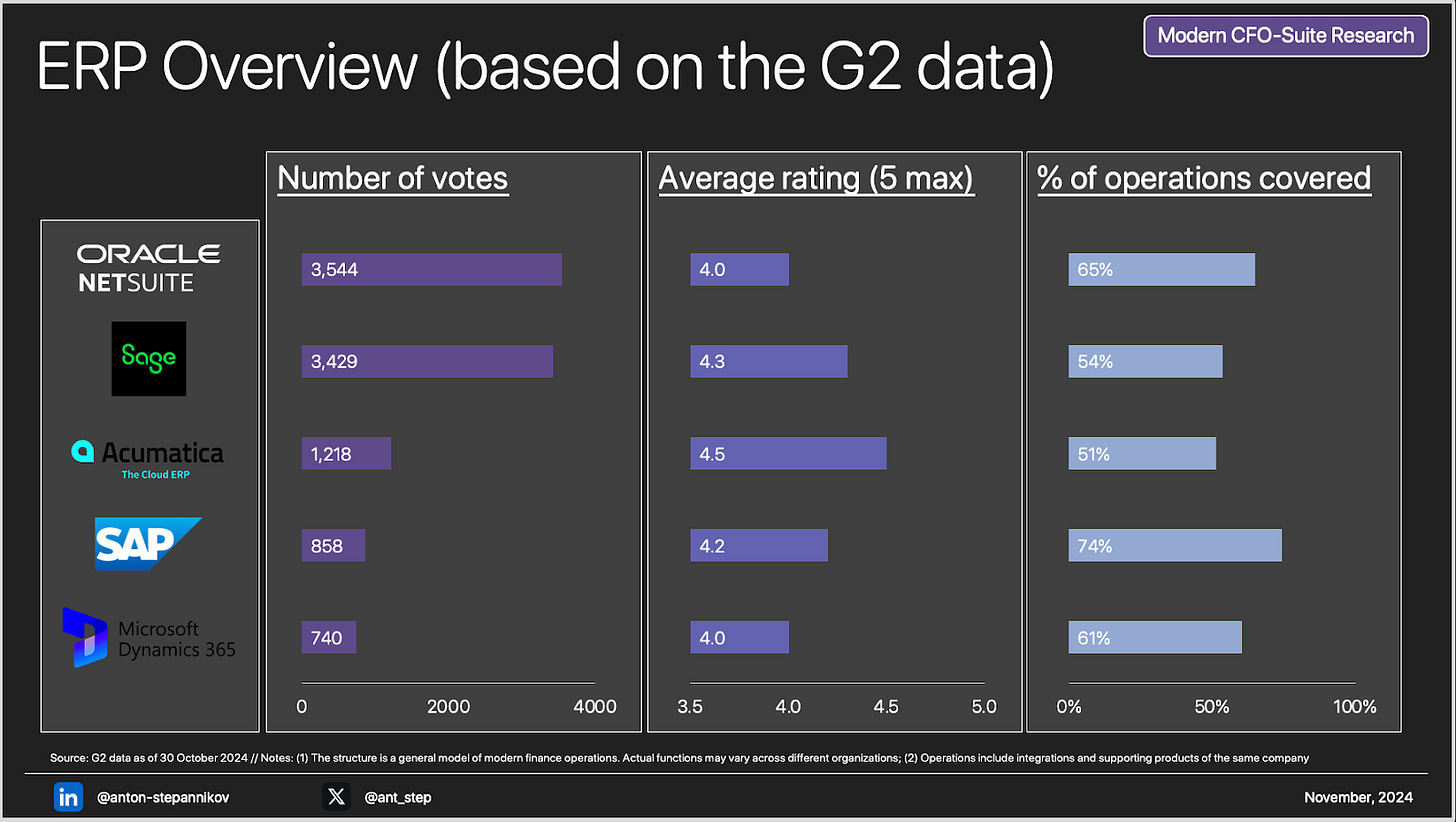

Enterprise Resource Planning (ERP) systems have been the backbone of financial operations, integrating critical functions like accounting, procurement, and supply chain management. Companies like Netsuite, Sage, Acumatica, SAP, and Microsoft offer comprehensive solutions that dominate the market.

However, ERPs often face limitations:

Complex Implementations. Deployments can take months, requiring substantial time and resources

Unintuitive UI. Steep learning curves can slow user productivity

High Costs. Expenses associated with ERPs can be prohibitive for small to medium-sized enterprises

Fueled by the flexible infrastructure of cloud services, a new wave of specialized startups has emerged to tackle key pain points in financial operations. Now, Gusto simplifies payroll, Ramp optimizes corporate spending, Navan enhances travel management, and Carta streamlines equity management.

Valued in the billions and attracting substantial investment, these companies are carving out niches by providing targeted solutions that ERPs struggle to deliver effectively.

AI Age of Finance Software

Despite the expansion of specialized tools, significant challenges remain. Issues like fragmented systems, data silos, and manual processes interfere with efficiency.

Now, AI in the form of LLMs and AI agents is stepping in to bridge these gaps.

The intersection of AI and finance technology is paving the way for a more streamlined and intelligent approach to financial operations. There are a number of vertical AI startups working in the space already.

From automation to enhanced compliance and real-time insights, AI-powered solutions are empowering finance teams to operate smarter and more effectively. Let’s dive into the key trends driving this transformation and highlight companies at the forefront of innovation.

1. The Automation Revolution

(Zeni webpage)

One of AI’s most transformative impacts is automating time-consuming financial tasks, minimizing errors, and freeing up resources for strategic work. Companies like Tabs and Palm are leading the way. Tabs integrates invoicing, receivables, payments, revenue recognition, and reporting into a single AI-powered platform, simplifying revenue operations for B2B finance teams. Palm automates bookkeeping and generates real-time financial reports, giving teams instant insights into their financial performance.

Zeni combines AI-powered bookkeeping with expert support, handling everything from bill payments to employee reimbursements and offering real-time financial visibility, so finance teams can focus on growth.

2. Real-Time Financial Insights

(Planful webpage)

AI’s ability to provide real-time, actionable insights is revolutionizing financial planning and analysis (FP&A). Planful uses AI to streamline budgeting, forecasting, and reporting, helping finance teams identify trends and make proactive, data-driven decisions. These platforms enable organizations to move from reactive to strategic financial management.

At the same time, solutions like Kick offer AI-driven financial management tools, including real-time transaction categorization, expense tracking, and multi-entity accounting, giving finance teams a comprehensive and up-to-the-minute view of their financial health.

3. Enhanced Compliance and Risk Management

(Agentive webpage)

AI is becoming essential for compliance and risk mitigation in an era of increasing regulatory complexity. AppZen provides AI-driven expense auditing, automatically reviewing reports in real-time to flag compliance issues and prevent fraud. This proactive approach ensures finance teams can address risks before they escalate.

Agentive offers an AI-powered audit copilot that assists in analyzing financial records and automating data extraction, speeding up audit procedures and improving accuracy. These tools make audits and compliance more efficient and reliable.

4. Simplified Tax Management

(April webpage)

Navigating tax regulations is another major challenge that AI is helping to solve. April provides AI-powered tax software that automates e-filing and delivers personalized tax insights. By seamlessly integrating with financial platforms, April simplifies tax season and helps finance teams optimize tax strategies while reducing the risk of errors.

5. Financial Insights

(Sapien webpage)

AI is also making research and corporate development activities more data-driven. Sapien offers an AI-driven financial advisory platform that provides tailored investment insights, helping finance teams align strategies with organizational goals. Rogo enhances financial management by delivering customized recommendations and data-driven action plans for better financial oversight, which might be used in M&A and decisions about their stocks for public companies.

On the investor relations front, Koios uses AI to detect stock manipulation threats and provides real-time intelligence, enhancing transparency and protecting financial assets.

What’s Next?

Finance software has evolved rapidly, from spreadsheets. But the real disruption is just beginning. Here’s what I think might be ahead:

Short-Term (1 Year)

Both Gartner and Sam Altman predict AI agents to be a part of daily workflows already in 2025. And I tend to believe them. Within a year, AI agents might automate complex tasks like predictive forecasting, compliance monitoring, and anomaly detection, streamlining financial operations and boosting efficiency.

Mid-Term (2-3 Years)

Over the next few years, I believe finance teams will manage unified platforms where AI agents automate most day-to-day tasks, from AP/AR to payroll, risk management, and audit. These integrated systems will consolidate fragmented tools and enable holistic, data-driven decision-making, transforming the back office into a strategic powerhouse.

Long-Term (>5 Years)

If (or when?) Artificial General Intelligence (AGI) becomes a reality, it could revolutionize finance software, enabling AI to make strategic decisions with human-like understanding. This advancement would transform financial planning and risk management but also introduce significant challenges in governance, ethics, and security, requiring careful oversight to ensure responsible use.

While challenges remain, the future of finance software is bright. With AI at its core, finance teams are set to decrease the amount of “monkey jobs” and have more impact. The companies that embrace these advancements will shape the future of the industry.

Anton